Case study. Implementation of the SAP System for Different Foreign Groups

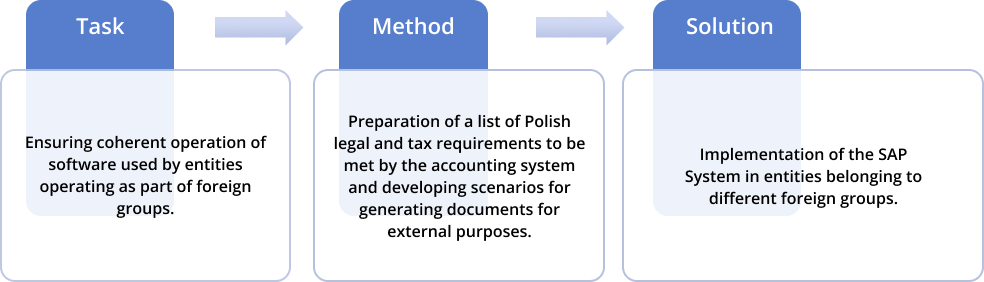

As a modern accounting firm, we quite often participate in the implementation of systems in our Clients’ companies. In such cases, we act as advisors and testers of accounting software. We make sure that when the systems are launched on the target databases, everything will work correctly and in accordance with the Polish Accounting Act, tax laws as well as individual Client requirements, e.g. for management purposes.

Recently, MDDP Outsourcing specialists have participated in the implementation of the SAP system for Clients belonging to different foreign groups. The entire implementation projects were carried out in English.

The Clients decided to change the system due to the requirements of the whole group, where the SAP system had already been in place. It seemed that the implementation processes in these entities would be similar and standard. This supposition was supported by the fact that SAP had been in place in the parent companies for some time, and each group had already cooperated with an implementation company and had its own team coordinating work progress from India, Italy or Germany.

PROBLEMS AND CHALLENGES

It turned out, however, that we encountered plenty of challenges, and the implementation processes took different and unexpected courses. In each case, we provided our Clients with a complete list of requirements that should be met by the accounting system for effective bookkeeping and preparation of reports, financial statements and tax calculations. However, group-specific circumstances did not always make it possible to deploy all the improvements.

One of the challenges we faced was the chart of accounts itself, used by all entities of the group in different countries. Things that are very convenient for the purposes of group consolidation do not have to be like that for particular entities. For the purposes of calculating income tax according to Polish regulations, it is useful to set up separate accounts to recognise costs other than tax deductible costs (balance sheet or off-balance sheet ones) or to introduce tags (e.g. MPK (cost centre)). Nevertheless, from the point of view of the parent companies, expanding the chart of accounts only for a single company from the group (usually one of the smaller ones, unfortunately) is not beneficial and is rather unacceptable. The introduction of tags is also difficult to achieve. Accounting teams in Poland are not free to set up accounts or adjust them to the Polish Accounting Act and tax laws.

The implementation of the JPK standard audit files turned out to be another challenge. Some Clients were very determined to meet all legal and tax requirements. They focused on system solutions that would not only facilitate work but also minimise the risk of errors. Others, in turn, found the implementation of JPK VAT to be too time-consuming and costly. They asked us to generate VAT registers from SAP and import them into our internal accounting system to ensure proper preparation of the required reports. Thanks to the work of our IT department, a list of posted sales and purchase invoices generated from SAP can be imported into the internal accounting system, from where a correct JPK file can be generated and submitted.

Another issue was the import of exchange rates from the National Bank of Poland (NBP) website. In the cases discussed, the companies of the group use the exchange rates of the European Central Bank, and it is necessary to set distinct rates only for Polish companies. In the case of the Clients who have a lot of foreign currency transactions each month, it was possible to implement an automated tool to update the exchange rate database. In another case, however, it was determined that the scale of this type of documents was so small that we could enter the exchange rates manually when posting individual documents.

Each of the Clients described also runs warehouse management. One of them, unfortunately, was forced to run warehouse management and issue invoices in a separate system, which had to be integrated with SAP so that all issued documents would be transferred automatically to the financial module without additional interference from the accounting teams. The other Clients run warehouse management in SAP, which significantly facilitates and speeds up the work. Purchase invoices are automatically linked with warehouse documents as early as at the posting stage. We can generate all necessary and complete data from one system at any time. When certain processes are run in other systems, there is always a risk that some documents will not be transferred from one database to the other; it is necessary to compare the data from both systems to make sure that they are complete.

Every Client has different requirements, and therefore, in addition to taking care of adjusting the system to the applicable regulations, we attach great importance to the Client’s requirements and expectations. Each of the implementation projects required a customised, unconventional and flexible approach, as well as a broad view of all processes running in SAP systems.

Author: Joanna Kargulewicz, Accounting Area Junior Manager at MDDP Outsourcing.