Financial Statements in iXBRL Format Compliant with the ESEF

Pursuant to a European Commission regulation, starting from 2021, all issuers whose securities have been admitted to trading on a regulated market in the territory of the European Union are required to prepare annual reports in the European Single Electronic Format (ESEF).

The new obligations relate to the marking-up of consolidated financial statements prepared in accordance with the IFRS using the XBRL markup language – as per the adopted taxonomies and principles. This obligation applies to financial years beginning on or after 1 January 2020.

ESEF reporting – support in the preparation of financial statements

MDDP Outsourcing, in cooperation with EQS Group, facilitates the process of preparing annual financial statements in iXBRL format for Polish groups. The service of preparing financial statements in XBRL format is a very good solution for numerous companies that every day struggle with newer and newer regulations and requirements.

Advantages of choosing the MDDP EQS ESEF service:

- time optimisation for clients’ teams;

- no long-term licence required;

- no need to install additional applications;

- no need to hire additional IFRS and IT experts;

- no need for long-term implementation and software updates;

- no need to deal with the complicated XBRL marking.

How does the MDDP EQS ESEF service work?

No expenditure on expensive software, no need for time-consuming changes to the financial statements preparation process; groups receive from us complete financial statements in iXBRL format.

Groups that have already used our service of converting financial reports to XML format know that not much will change for them in the existing process of preparation of their annual financial statements.

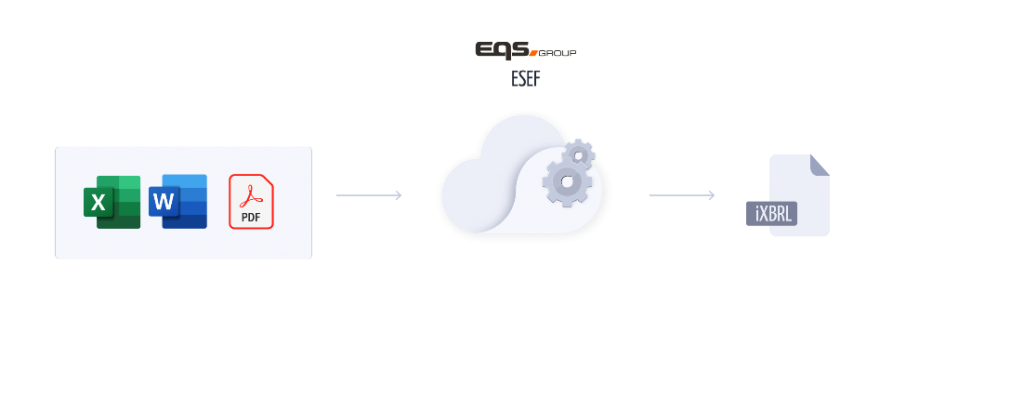

The report is sent in a common format (Word or PDF) to the EQS COCKPIT system. Having received the report, the IT team, in cooperation with the IFRS team, converts the report to XHTML, along with tagging of the mandatory items according to the XBRL/iXBRL markup language.

The iXBRL file having been prepared, the report is securely made available for download in the EQS COCKPIT system. After the report is approved by the issuer, the financial statements are approved in the Polish Financial Supervision Authority system (ESPI).

The marking-up (tagging) service for the financial statements sent to us by a client facilitates the process of preparing an annual report compliant with the ESEF, in line with all regulations applicable at the date of its publication.

What is the ESEF?

The ESEF (European Single Electronic Format) is a uniform European reporting format in which all issuers whose securities are admitted to trading on a regulated market in the territory of the European Union are required to prepare their annual reports.

The overarching aims of implementing the ESEF include the following:

- ensuring greater transparency and comparability of financial statements, regardless of their language, structure or format;

- facilitating the creation of financial databases on issuers.

Digitization of financial information provided by issuers in a manner that ensures its readability in web browsers will also enable machine reading by specialized IT software. According to the new, uniform standard, annual reports are to be published with the use of the XHTML language, whereas the annual consolidated financial statements prepared in line with the IFRS should be additionally marked up with XBRL tags.

When will the ESEF requirements take effect?

The new ESEF requirements apply to financial years beginning on or after 1 January 2020. However, some of the changes will only take effect as of 2022. The new arrangements will enter into force in two phases:

From January 2020 – PHASE 1

Marking-up (tagging) of the main consolidated financial statements, i.e.:

- Statement of financial position,

- Statement of profit and loss and statement of comprehensive income,

- Statement of changes in equity,

- Statement of cash flows,

plus other disclosures indicated by the ESMA, covering the following 10 mandatory items:

- Name of the reporting entity or other means of identification;

- Explanation of change in name of the reporting entity or other means of identification from the end of the preceding reporting period;

- Domicile of the entity;

- Legal form of the entity;

- Country of incorporation;

- Address of the entity’s registered office;

- Principal place of business;

- Description of the nature of the entity’s operations and its principal activities;

- Name of the parent company;

- Name of the ultimate parent of the group.

The above 10 other mandatory disclosures are to be tagged as text.

From January 2022 – PHASE 2

The requirements for marking-up (tagging) are the same as in phase 1, but the list of mandatory items has been extended as follows:

- Length of life of a limited life entity;

- Statement of IFRS compliance;

- Explanation of departure from IFRS;

- Explanation of financial effect of departure from IFRS;

- Disclosure of uncertainties of the entity’s ability to continue as a going concern;

- Explanation of the fact and basis for preparation of financial statements when not going concern basis;

- Explanation of the reason why the entity is not regarded as a going concern;

- Description of the accounting policy.

Phase 2 introduces mandatory block labeling of the notes. (Optional) detailed labeling of the notes will also be possible.

What is XBRL?

XBRL (Extensible Business Reporting Language) is a technology for making up information that enables this information to be identified and described within an entity’s financial statements. XBRL tags should be included by issuers in the XHTML document (Extensible HyperText Markup Language), i.e. the format of their consolidated financial statements. XHTML should be readable by almost any web browser.

What does the new iXBRL format mean?

- All annual reports are prepared by issuers in XHTML format; these reports can be opened and viewed with a standard web browser.

- Consolidated financial statements prepared in accordance with the IFRS, which are components of consolidated annual reports, are tagged with the XBRL markup language.

- XBRL tags should be included in the XHTML document using the Inline XBRL standard specification.

- The taxonomy to be used is an extension of the IFRS taxonomy developed by the IFRS Foundation.

As the ESEF is based on XBRL technology, no other format will be accepted.

ESEF – reporting with the support of an XBRL advisor

Each company has its own specifics, and its financial processes associated with reporting are structured in a different way. Listed companies, due to the size and sensitivity of data, require special attention. The finance departments of such enterprises need a thorough knowledge of the IFRS and stock exchange reporting. Relieving companies by choosing a professional XBRL advisor, who will prepare financial statements in XBRL format efficiently and without errors, is most certainly a beneficial solution.

Moreover, the time and resources required to select (and also implement) the appropriate software and train personnel in this area may exceed the capabilities of smaller companies. Choosing an XBRL advisor may prove to be a cost-effective and well-founded solution.

If you decide to use MDDP Outsourcing services, you can rely on our practical knowledge of the tool needed to prepare the required format and its specifics as well as our subject-matter knowledge necessary to perform the service.

We encourage you to take advantage of the services of the MDDP Outsourcing reporting team by contacting our accounting offices in Warsaw and Katowice.

Leave us a message or call our office

Discover our services

MDDP Outsourcing Experts remain at your disposal. We will be glad to answer any inquiries regarding our services, offer quotations and other issues related to our company.

For more details please use the contact form.

Call us

Accounting office in Warsaw

tel. (+48) 22 351 13 45

Accounting office in Katowice

tel. (+48) 32 797 83 50