Signing and submitting financial statements in Poland in XML to the Polish National Court Register

Every entity that maintains books of accounts is required to prepare statements in electronic form – hereinafter “XML”. It is mandatory that the report be signed with a qualified electronic signature or a trusted signature by the person entrusted with keeping the accounts and the head of the entity. The signature should be affixed by the entire Board of Directors or, in accordance with the changes introduced on January 1, 2022 in the Polish Accounting Act (hereinafter “AA”) (Article 52(2b)), by one member of a multi-member board. The other members of the board are then required to make the appropriate statements in the system. This article describes instructions on how to properly sign and submit financial statements in XML to the National Court Register.

No single template for the above statement has been specified. However, it should include a statement that the financial statements in XML meet the requirements of the AA. It is also necessary to indicate which financial statements the statement relates to, by stating the date and time when the statement was signed by the person entrusted with keeping the ledgers (Article 52(2c)). The statement can be prepared in two forms: paper (signed by hand) or electronic (signed electronically: qualified electronic signature, trusted signature or personal signature).

If the statement is made on paper, it is necessary to make an electronic version of it (it should be scanned), so that it can be attached to the e-financial statements ( financial statements in XML) – this is the task of the board member who signed the financial statements (Article 52 (2e)) – in addition, at this stage there is no obligation to authorize the copy with an electronic signature. Similar arrangements apply to refusal to make a statement.

Signature of the financial statements in Poland

As the first, the signature on the e-statement is usually provided by the person entrusted with keeping the ledgers (preferably on the day the XML file is prepared, as a confirmation of the existence of a certain asset and financial status as of a specific balance sheet date. However, the Act does not specify that the first signature must be affixed on the same day), followed by the signatures of the board members. The above order applies if none of the above persons use an ePUAP trusted signature (it is recommended that signatures submitted in ePUAP form be submitted first which is described in the following section).

The signatures of individual members of a multi-member board need not be affixed on a single day. On the other hand, in order for the financial statements to be prepared in a complete manner, in accordance with the AA, they should be signed by everyone no later than three months after the balance sheet date.

Currently (as of 30.09.2022), in connection with the Regulation of the Minister of Finance dated March 7, 2022, amending the Regulation on the determination of other deadlines for fulfilling obligations for records and for preparing, approving, making available and transmitting to the competent registry, the entity or authority of reports or information, other entities are required to submit signatures on XML within six months after the balance sheet date.

Types and order of signatures on financial statements in XML

Depending on which electronic signature format each of the above mentioned individuals uses, the number of files that will be processed will vary.

- Trusted signature (ePUAP)

With this type of signature, it is possible to sign documents saved as a single file on the local disk, with a file size of no more than 10 MB and extensions: txt, .rtf, .pdf, .xps, .odt, .ods, .odp, .doc, .xls, .ppt, .docx, .xlsx, .pptx, .csv, .jpg, .jpeg, .tif, . tiff, .geotiff, .png, .svg, .wav, .mp3, .avi, .mpg, .mpeg, .mp4, .m4a, .mpeg4, .ogg, .ogv, .zip, .tar, .gz, .gzip, .7Z, .html, . xhtml, .css, .xml, .xsd, .gml, .rng, .xsl, .xslt, .TSL, .XMLsig, .XAdES, .PAdES, .CAdES, .ASIC, .XMLenc, .dwg, .dwf, .dxf, .dgn, .jp2.

When signing electronic documents with the ePUAP trusted profile, a single file in XML format is created, which contains both the signed content and all electronic signatures (if there are more). When using an ePUAP signature, one file can be signed. Therefore, individuals with qualified electronic signatures (described in the following section), using which they submit the so-called external signature (saved as a separate file outside of XML) should submit them after those who sign the report with ePUAP – it is recommended that signatures submitted in ePUAP form be submitted first.

For more information on the ePUAP trusted signature, follow the link: www.gov.pl/web/gov/podpisz-dokument-elektronicznie-wykorzystaj-podpis-zaufany

- Qualified electronic signature

This signature, depending on the certificate you have, can be made in two different formats – as podpis surrounded (internal) and external signature. The first creates a signature inside the XML file that contains the financial statements (when saved, it may have an XADES extension). The second, on the other hand, is an external signature, that is, when signing XML, a second file is created, which must always be sent together with the XML file containing the report, the XML file and the XADES signature file are integral with each other. Once the XML file has been externally signed, it must not be edited, because when the XML source file is edited, the additional XADES signature file will lose its validity, which is verified by the KRS system.

- Qualified electronic signature as a surrounded (internal) signature.

This signature will be saved as a single file (along with the XML compactness) in the Xades extension (Type: XADES File) – this file is then larger than the source document, so the signature has been appended to the XML content, and you should continue to use only the XADES file.

- Qualified electronic signature as an external signature.

This signature will be saved as a separate file in the Xades extension (Type: XADES File), which is integral to the XML extension file (Type: XML File) – this can be recognized by the size of the files (the XML file is much larger, the signature file is smaller and must be attached along with the XML).

In any case, the XML and XADES files should be saved to a single location on the local disk.

If you have technical problems with your qualified signature, contact the technical support of the certificate issuer in question. MDDP Outsourcing as an entity that prepares e-financial statements in XML form is not responsible for technical problems with its clients’ qualified signatures.

Submission of XML to the Polish National Court Register – the most important information

A submission to the National Court Register can be made by a board member with a PESEL, which is indicated both in the KRS and in the electronic signature. The submission may also be made by a proxy disclosed in the National Court Register with a PESEL number or a natural person whose PESEL number is disclosed in the National Court Register, entered in the system as a person authorized alone or jointly with other persons to represent the entity, as well as a proxy, attorney, legal counsel or foreign lawyer. The individual entrusted with submitting XML and signatures to the National Court Register is also tasked with preparing additional files necessary for correct submission.

To the National Court Register within 15 days from the date of approval of the financial statements must be submitted:

- E-statement in XML format (except for reports prepared according to IAS) with necessary signatures.

- Activity report electronically signed by the Head of the Unit.

- If the financial statements are audited, it is also necessary to submit the expert auditor’s report on the financial statements.

In addition, it is necessary to submit documents that do not need to be electronically signed:

- Resolution or decision on approval of financial statements.

- Resolution on distribution of profit or coverage of loss.

Entities listed in the Polish National Court Register’s Register of Entrepreneurs, such as corporations and partnerships make their filing through a free path – the Financial Document Repository (https://ekrs.ms.gov.pl/).

Other important issues in the XML e-report file that need to be paid attention to when submitting it to the National Court Register:

- The period for which the financial statements were prepared – at the time of submitting XML to the National Court Register, the person preparing the application in the system is required to indicate this period. If the XML differs in this regard, the system will not allow further processing of the files.

- The date of the XML – this is the date of generation of the e-report, i.e. the date on which the individual entrusted with bookkeeping has included events that affect the form of the report – on this date the individual usually also signs the generated XML, and this date should be indicated in the appropriate place when submitting the XML to the National Court Register.

- Legal basis – the system will not allow further processing of the XML file in the National Court Register if the legal basis (at least in the first column “Art.”) is not entered in each income tax calculation item in the XML structure.

Ministry of Finance provides most common questions and answers on e-reporting:www.podatki.gov.pl/e-sprawozdania-finansowe/pytania-i-odpowiedzi/

How to submit financial statements in XML to the National Court Register in Poland?

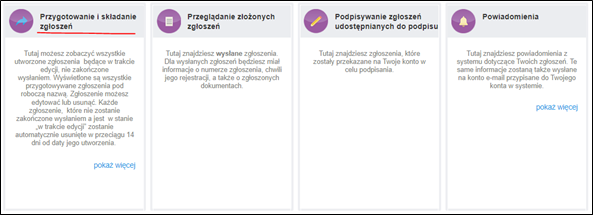

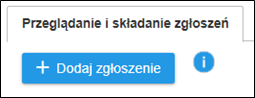

After logging in to the system, go to the “Preparing and filing” section and select the “Add filing” option for the company to be searched by National Court Register number.

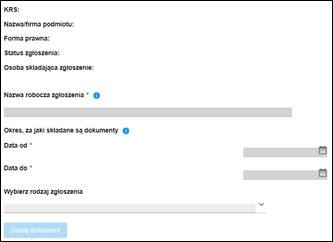

Under the section “Individuals authorized to represent the entity” and “Financial documents submitted”, go on to register a new application. Here, it is necessary to complete the working name of the submission, enter the period for which the documents are submitted (as indicated above, this period must match the period entered in the e-statement file), and select the type of submission (“Submission of financial statements and other financial documents” or “Submission of group financial statements and other documents”).

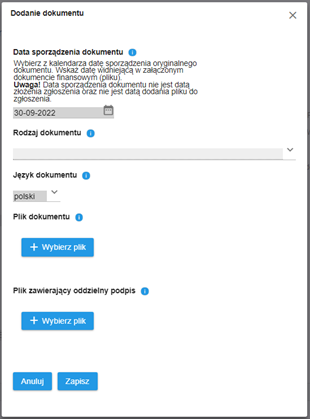

In the “Add Document” window, indicate the date of the document (according to the date indicated in the XML file), and then select the type of document (from the drop-down list). In the “Document file” section, attach an XML file (signed with an encircled or external signature) and, if external signatures have been applied, attach an Xades file with signatures in the “Separate signature file” section. If the files are drawn up correctly, after selecting “Save” the system will correctly generate a new submission.

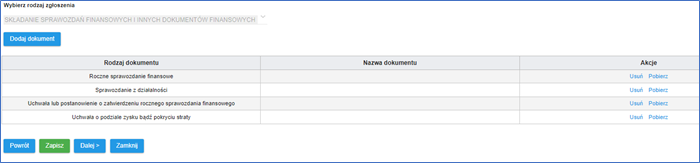

In the next steps, all additional files necessary for the correct submission of the annual financial statements listed above should be submitted in a similar manner.

In a situation where there is a problem with processing the attached files, the system should indicate the errors – at the bottom of the view below you should see a “Download report” window, which will mark the errors in the XML structure – downloading the nonconformity report will help in faster verification of possible errors.

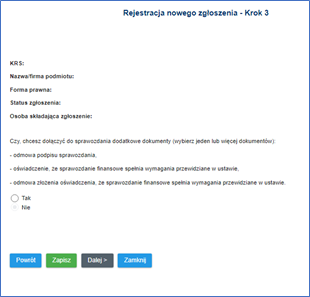

After adding all the necessary documents, it is necessary to save the current version of the submission. After moving on, it will be necessary to complete the information on whether to include additional documents such as refusal to sign the statement or submission of an affidavit or refusal to submit a statement that the financial statements meet the requirements of the act (described above regarding the submission of signatures by a multi-member board).

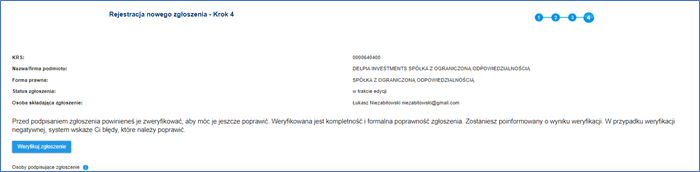

After saving the current submission and moving on, it is necessary to verify the correctness of the submission by selecting “Verify submission” and save again if accepted by the system and sign. If the system does not load the next page, save the current form of submission and move on. After the signing by the individual indicated in the National Court Register and submitting the submission, it is necessary to open the submission in edit mode and send it to the Financial Document Repository. When the submission is submitted correctly, a corresponding message will appear.

Author: Izabella Kuźma, Specialist in the reporting department at MDDP Outsourcing.

Sources:

Act of September 29, 1994 on accounting.

Regulation of the Minister of Finance of March 7, 2022

Financial Document Repository.

Questions and answers on e-financial statements.

See more:

Obligation to audit financial statements by an expert auditor