The Polish Deal – the Minimum Tax

1 January 2022 will mark the entry into force of the recently added Art. 24ca of the Corporate Income Tax Act, which introduces a new kind of CIT, the so-called minimum tax.

ENTITIES LIABLE FOR THE MINIMUM TAX

Contrary to the initial announcements that it was supposed to apply only to foreign multinationals, the obligation to pay the minimum tax will be imposed on all entities that account for CIT, without any significant exceptions. This obligation will also cover micro-enterprises, entities from the SME sector, start-ups and entities operating in Poland through their foreign establishments.

Taxpayers will for the first time calculate and pay the minimum tax on the basis of CIT-8 returns submitted for 2022 in 2023.

GROUNDS FOR THE PAYMENT OF THE MINIMUM TAX

The obligation to pay the minimum tax will arise if, during a tax year, a taxpayer:

- incurred a loss from a revenue source other than capital gains or

- obtained a share of income from a revenue source other than capital gains in revenue other than capital gains of no more than 1%.

For the purposes of the minimum tax, loss is defined in a slightly different way compared to the classic CIT, and thus it will not be possible to determine it without making a few additional exclusions. It all comes down to the fact that taxpayers will have to create additional formulas in their calculations so as to allow for the separate calculation of the tax result for the purposes of the minimum tax.

Hence, for the purposes of calculating loss and a share of income in revenue, the following items shall not be taken into account:

- the costs arising from the acquisition, production or improvement of fixed assets recognised in the tax year as tax-deductible costs, including through depreciation;

- the revenue and tax-deductible costs directly or indirectly related to this revenue earned or incurred, respectively, in connection with a transaction where:

- the price or the method of determining the price of the object of the transaction is based on statutory provisions or secondary legislation issued thereunder and

- during the a year, the taxpayer incurred a loss from a revenue source other than capital gains from a transaction referred to in (a) or obtained a share of income from a revenue source other than capital gains in revenue other than capital gains arising from such a transaction of no more than 1%, with the proviso that the calculation of loss and a share of income in revenue shall be made separately for transactions of the same type.

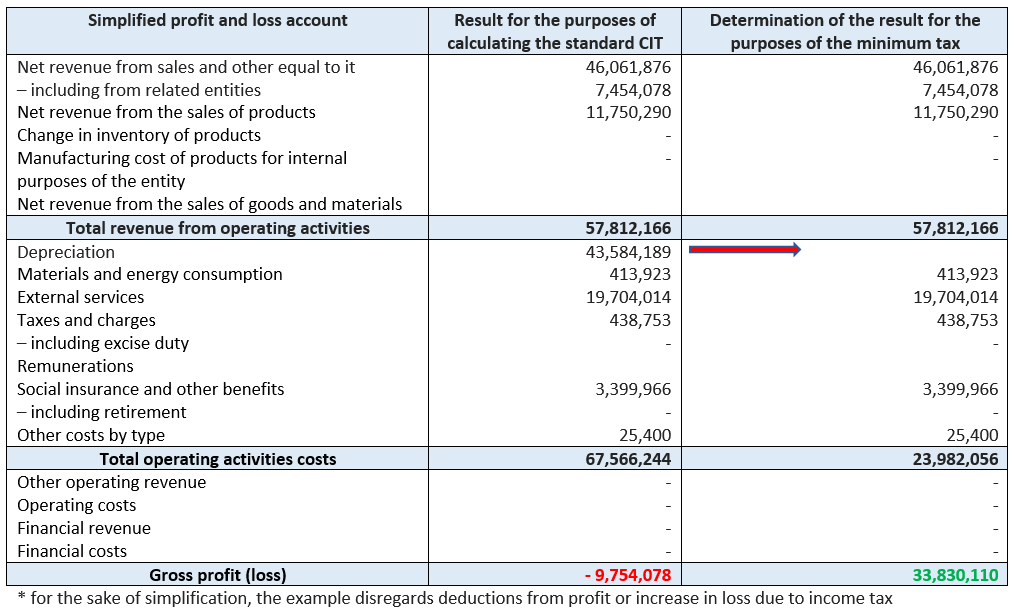

The above can be illustrated by a simple example:

At first glance, it seems that the entity in the above example will be obliged to calculate the minimum tax due to the loss it incurred. However, by excluding depreciation costs for the purposes of the minimum tax, a hypothetical profit is shown, and therefore there is no need to calculate the minimum tax.

The provision that mandates the exclusion of depreciation costs was enacted mainly in fear of discouraging entrepreneurs from any investment projects, which significantly stimulate the economy, e.g. by creating new jobs.

ENTITIES EXEMPTED FROM THE MINIMUM TAX

The legislature exempted certain groups of taxpayers from the obligation to pay the minimum tax. The number of these exemptions, however, is quite modest, which only further shows the legislature’s complete failure to understand the mechanisms of the functioning of Polish enterprises.

The group of entities exempt from the minimum tax include the following:

- taxpayers who start business activities in the first three years (taxpayers established as a result of restructuring projects referred to in Article 19(1a) of the CIT Act will not be recognised as such, though);

- financial enterprises (exhaustively enumerated in Article 15c(16) of the CIT Act)*;

- taxpayers who, during a tax year, obtained revenue lower by at least 30% compared to the revenue in the preceding year;

- taxpayers whose shareholders or partners are only natural persons and where the taxpayer does not hold the following: a shareholding in another company or participation units of an investment fund or a collective investment institution; all rights and obligations in an unincorporated company or partnership; and other property rights related to the right to receive a benefit as a founder (settlor) or beneficiary of a foundation, trust or other entity, or a legal relationship of a fiduciary nature;

- taxpayers who obtain most of their revenue in connection with the operation of sea-going vessels or aircraft in international transport or the extraction of minerals listed in the Schedule to the Act of 9 June 2011 – Geological and Mining Law (Journal of Laws of 2021, item 1420) the prices of which depend directly or indirectly on price quotations in world markets;

- taxpayers being members of tax capital groups which meet the additional criteria described in Art. 24ca.

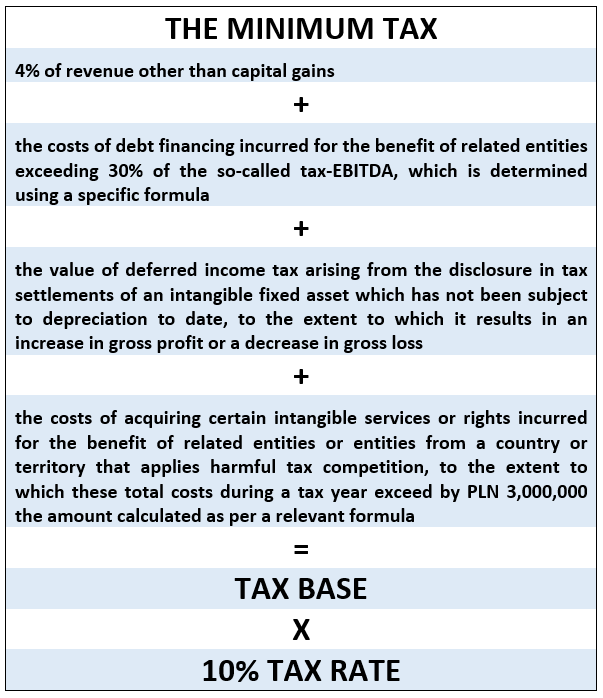

TAX BASE

The tax base for the minimum tax is the sum of the following components:

PAYMENT OF THE TAX

The minimum tax is payable to the bank account of the relevant tax office by the end of the third month of the following year. Importantly, taxpayers will be entitled to deduct it from the CIT calculated in accordance with Art. 19 of the CIT Act in tax returns for the three tax years immediately following a year for which the minimum tax was paid. The legislature also allows the minimum tax to be deducted from the standard CIT. Author: Agnieszka Piętak, Accounting Area Manager at MDDP Outsourcing

————————————————————————————————————* Financial enterprises referred to in Art. 15 c(16) of the CIT Act

- a domestic bank referred to in Art. 4(1)(1) of the Act of 29 August 1997 – Banking Law;

- a credit institution referred to in Art. 4(1)(17) of the Act of 29 August 1997 – Banking Law;

- a credit union and the National Credit Union;

- an investment firm referred to in Art. 3(33) of the Act of 29 July 2005 on Trading in Financial Instruments;

- an investment fund company, an alternative investment company manager, a management company and a manager from the European Union referred to in Art. 2(3), (3a), (10) and (10c), respectively, of the Act on Investment Funds;

- a domestic insurance company and a foreign insurance company within the meaning of Art. 3(1)(18) and 3(1)(55), respectively, of the Act of 11 September 2015 on Insurance and Reinsurance Activities (Journal of Laws of 2021, item 1130);

- a domestic reinsurance company and a foreign reinsurance company within the meaning of Art. 3(1)(19) and 3(1)(56), respectively, of the Act of 11 September 2015 on Insurance and Reinsurance Activities;

- a voluntary fund within the meaning of Art. 8(3a) of the Act of 28 August 1997 on the Organisation and Operation of Pension Funds;

- an open fund within the meaning of Art. 8(5) of the Act of 28 August 1997 on the Organisation and Operation of Pension Funds;

- an employee fund within the meaning of Art. 8(6) of the Act of 28 August 1997 on the Organisation and Operation of Pension Funds;

- a fund company within the meaning of Art. 8(7) of the Act of 28 August 1997 on the Organisation and Operation of Pension Funds;

- a foreign employer within the meaning of Art. 8(10) of the Act of 28 August 1997 on the Organisation and Operation of Pension Funds;

- a foreign manager within the meaning of Art. 2(24) of the Act of 20 April 2004 on Employee Pension Schemes (Journal of Laws of 2020, items 686 and 2320);

- open-end investment funds and alternative investment funds established pursuant to the Act on Investment Funds;

- a central counterparty within the meaning of Art. 2(1) of Regulation (EU) No 648/2012 of the European Parliament and of the Council of 4 July 2012 on OTC derivatives, central counterparties and trade repositories (OJ EU L 201, 27.07.2012, p. 1, as amended);

- a central securities depository within the meaning of Art. 3(21a) of the Act of 29 July 2005 on Trading in Financial Instruments.